00-Husband wife. At rate B23b.

How To Step By Step Income Tax E Filing Guide Imoney

Paying income tax due accordingly may avoiding you from being charged tax increase court action and.

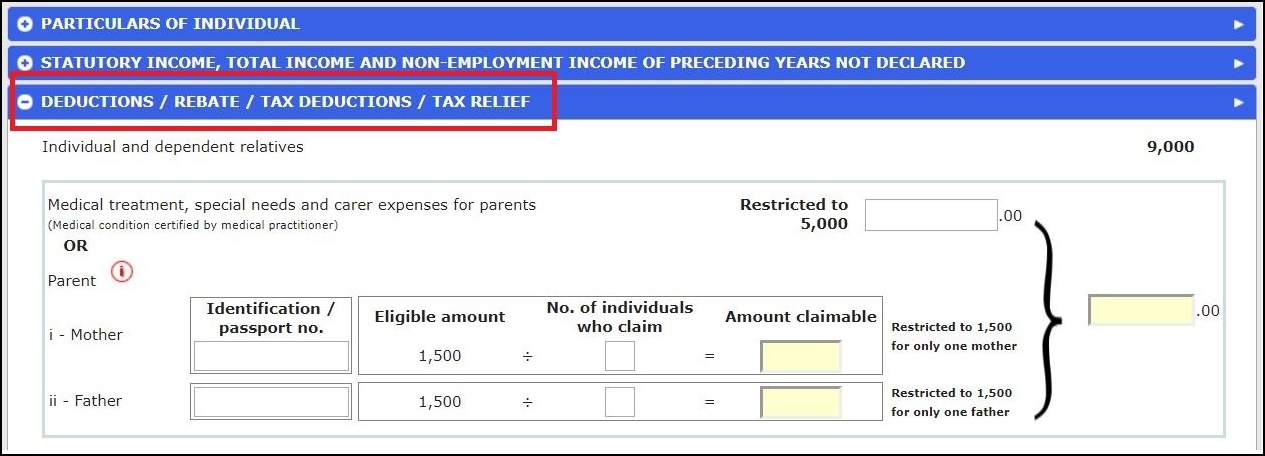

. The amount of instalment payments or tax deduction made in hisher own name has to be transferred to item F3 Form. On the First 5000 Next 15000. Total Rebate Self Husband.

In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you should be filing. They will be subject to tax for any foreign-sourced income received in Malaysia effective from 1 January 2022. On the First 20000 Next 15000.

Calculations RM Rate TaxRM A. For individuals with business income income other than employment income you will need to file the Form B. On the First 5000.

Click on Permohonan or Application depending on your chosen language. I total income of husband - rm76463 ii total income transferred from wife - rm60000 with business income iii tax p ayable in the name of the husband - rm2000000 iv instalments paid by the husband - rm1000000 v instalments paid by the wife - rm300000 the wife does not have to fill in parts d. 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

FAQs about Form B. To clarify other gains and profits is defined as payments received for part-time or any broadcasting lecturing writing and other. B21b Tax on the balance.

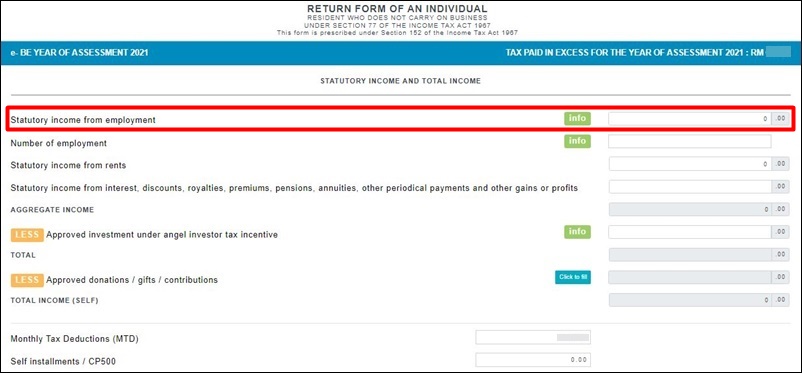

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. In this form you will be able to declare your side income under Statutory income from interest discounts royalties pensions annuities other periodical payments and other gains and profits. On the First 35000 Next 15000.

Imposition Of Penalties And Increases Of Tax. LEMBAGA HASIL DALAM NEGERI MALAYSIA AMENDED RETURN FORM OF AN INDIVIDUAL RESIDENT WHO CARRIES ON BUSINESS UNDER SECTION 77BOF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 2021 YEAR OF ASSESSMENT CP6F Pin. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated 30 December 2021. Cancellation Of Disposal Sales Transaction. For the item Income tax no enter SG or OGfollowed by the income tax number in the box provided.

B21 INCOME TAX COMPUTATION Refer to the tax rate schedule provided at the LHDNM Official Portal httpwwwhasilgovmy B21a 00Tax on the first. Pegangan Dan Remitan Wang Oleh Pemeroleh Available in Malay Language Only Shares In Real Property Company RPC Procedures For Submission Of Real Porperty Gains Tax Form. 2021 1 B AMENDED RETURN FORM.

ExampleFor Income tax no. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. 00 B23 - Departure levy for umrah travel.

Resident individuals who do not carry on a business will file the BE form whereas resident individuals who do carry on a business will file the B form. Assessed in the name of the spouse both are still reguired to fill out separate tax forms BBEThe husband or wife whose income is to be assessed in the name of the spouse does not have to fill in items C35 and C36 Part D Part E and Part F. It is time to submit Form B.

B 2020 RESIDENT INDIVIDUAL BUSINESS - 1 - b BASIC PARTICULARS 1 - 4 Fill in relevant information only. B24 TOTAL INCOME TAX B23a B23b B24. B23 INCOME TAX COMPUTATION Refer to the tax rate schedule provided at the LHDNM Official Portal httpswwwhasilgovmy B23a Tax on the first.

B23b 00Tax on the balance. Total rebate - Self. If you need further step-by-step guidance on how to fill in your income tax form do also check out our income tax guide for 2022 YA2021 here.

On the First 50000 Next 20000. Assessed in the name of the spouse both are still reguired to fill out separate tax forms BBEThe husband. Form BE income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business.

Click on e-Filing PIN Number Application on the left and then click on. B22 TOTAL INCOME TAX B21a B21b B22. If youd like to retrieve it online head over to the LHDN Maklum Balas Pelanggan Customer Feedback website.

00 N Zakat - Departure levy for umrah travel. 00 At rate B21b. In the name of hisher spouse both are still reguired to fill out separate tax forms BBEThe husband or wife whose income is to be assessed in the name of the spouse shall be required to enter 0 for item C32.

12021 prior to the extended grace. Assessment Of Real Property Gain Tax. Agreement with Malaysia and Claim for Section 133 Tax Relief HK-10 InstalmentsSchedular Tax Deductions Paid 31.

Total 00rebate - Self. The 2022 filing programme is broadly similar in concept to the position laid out in the original 2022 filing programme see Tax Alert No. Best Fixed Deposit Accounts In Malaysia July 2022.

B21 INCOME TAX COMPUTATION Refer to the tax rate schedule provided at the LHDNM Official Portal httpwwwhasilgovmy B21a Tax on the first. 4 the husbands form bbe is as follows. At Rate B21b.

B21b 00Tax on the balance. B22 TOTAL INCOME TAX B21a B21b B22. Form B income assessed under Section 4 a 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership.

Form BE Form B TOTAL INCOME - SELF Form BE Form B Form BE Form B or or or C34 C35 C36 C16 C17 C18. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Who needs to.

Items C33a and C33b have to be filled in also. What is Form B Form B is the income tax return for individual with business income income other than employment income. The amount of instalment payments or tax deduction made in the name of the individual and the spouse have to be totalled and.

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Business Income Tax Malaysia Deadlines For 2021

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Guide 2022 Ya 2021

How To Claim Income Tax Reliefs For Your Insurance Premiums

Guide To Using Lhdn E Filing To File Your Income Tax

How To Do Your Taxes In 2022 Cbs News

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Business Income Tax Malaysia Deadlines For 2021

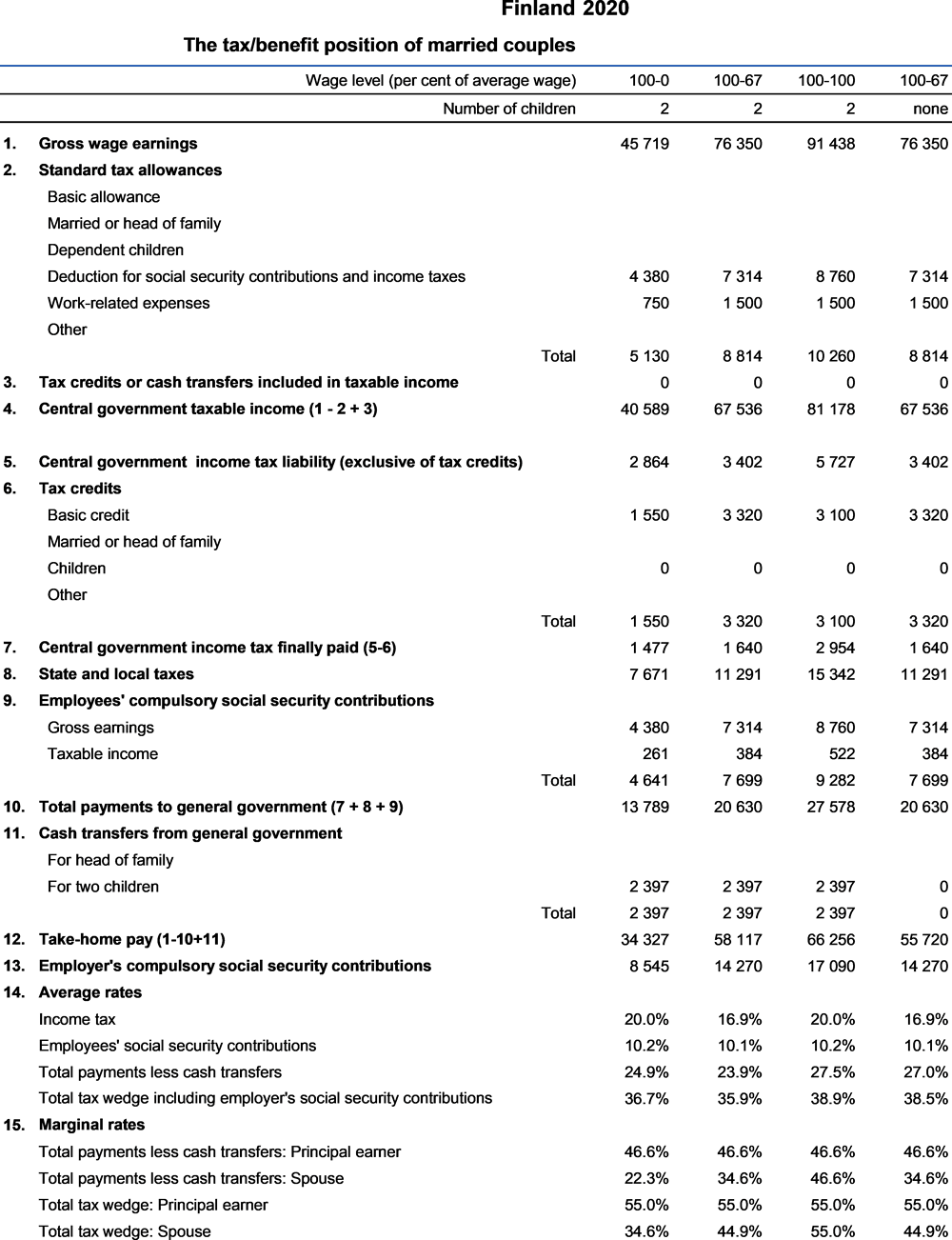

Finland Taxing Wages 2021 Oecd Ilibrary

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Malaysia Personal Income Tax Guide 2021 Ya 2020

Business Income Tax Malaysia Deadlines For 2021

Malaysia Personal Income Tax Guide 2022 Ya 2021